The entire process of SBLC monetization could be divided into numerous actions. To start with, the holder with the SBLC will have to submit the instrument to your monetization company for evaluation.

In the beginning, a comprehensive comprehension of SBLC monetization is vital, followed by the meticulous preparing and submission of all essential documentation.

Inside the realm of trade finance, a Standby Letter of Credit (SBLC) is a crucial financial instrument that serves for a promise of payment, issued by a lender on behalf of the consumer should they fall short to satisfy a contractual dedication.

Non-recourse loans will also be backed by devices that invest in governing administration bonds, offering corporations with the flexibility they have to secure funding devoid of sacrificing beneficial belongings.

Credible financial institution instruments ISSUED are getting to be Increasingly more well-liked on earth of finance, as they provide traders a novel possibility to crank out mounted cash flow funds flows.

The whole process of SBLC monetization will involve a number of strategic steps, Every single with its crucial great importance and requisite protocols.

The SBLC monetizer can take on the chance associated with the SBLC and assumes responsibility for ensuring which the SBLC is valid and enforceable.

In addition, knowing the legal implications inherent in monetizing such instruments is critical, ensuring all transactions adjust to international banking regulations and requirements.

Means of Disbursement: The disbursement method will vary depending on the precise settlement. Frequent ways of disbursement in SBLC monetization include:Money Payment: The monetization associate may transfer the agreed-on hard cash quantity straight into the beneficiary’s bank account.Mortgage: In place of a direct money payment, the monetization husband or wife may present the beneficiary which has a personal loan using the SBLC as collateral.

The disbursement stage is an important stage in the whole process of monetizing a Standby Letter of Credit (SBLC). In the course of this period, the monetization lover presents the beneficiary (the holder on the SBLC) Using the cash or economic instruments as arranged while in what is mt700 the monetization arrangement. Listed here’s a far more specific clarification with the disbursement process:

Liquidity: Monetization presents instant usage of cash, which can be crucial for seizing time-sensitive opportunities or addressing monetary requirements.

This can be specifically essential for companies that run in higher-danger industries or take care of unfamiliar counterparties.

Increased Fiscal Adaptability: SBLC monetization can offer you far more overall flexibility in comparison to standard financial loans and credit rating traces, because it’s structured throughout the value of the SBLC.

The entire process of acquiring a standby letter of credit score (SBLC) is similar to securing a business bank loan, but usually there are some essential distinctions.

Ben Savage Then & Now!

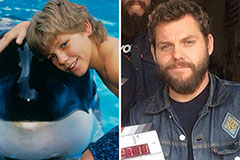

Ben Savage Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!