SBLCs, like conventional letters of credit, are valuable for international trade and domestic transactions like regional building assignments. Really should a thing unforeseen stop conditions of a offer to become done, the SBLC makes sure money obligations to a beneficiary are met.

Monetization is converting a monetary instrument, like an SBLC or BG, into money or credit. Having said that, selecting a trustworthy and honest monetizer is crucial in order to avoid frauds and fraud.

Banking companies may possibly demand collateral, like cash deposits or belongings, depending on the applicant’s creditworthiness and also the transaction’s risk profile. After collateral is arranged, the financial institution drafts the SLOC in compliance with pointers such as the Uniform Customs and Practice for Documentary Credits (UCP 600). The finalized doc is issued to your beneficiary, both straight or via an advising bank.

A standby Letter of Credit (SBLC) works as an extra guarantee or address inside of a trade settlement. It is a method of documentary credit where by the bank gets to be a guarantor to the seller with the payment.

Once you've concluded and submitted these documents, We are going to assessment them to be sure every thing is as a way. Right after this, AltFunds International or the legislation firms we function with will offer you a Company Settlement. With these files finished, we will commence issuing your SBLC.

Despite the fact that an SBLC is often a guaranteed payment, both equally vendor and purchaser should oblige for the trade agreement conditions. The terms laid out in the SBLC should even be fulfilled prior to the financial institution releases the credit.

Research: The monetization provider conducts a radical due diligence course of action to assess the authenticity and validity on the SBLC. This requires verifying the terms and conditions outlined during the SBLC.

Letters of credit are sometimes called negotiable or transferrable. The issuing lender pays a beneficiary or perhaps a financial institution that may be nominated from the SBLC MONETIZATION beneficiary. As being the beneficiary has this electric power, They might ‘transfer’ or ‘assign’ the proceeds of the letter of credit to a different business.

Customers utilize the standby letter of credit as being a secondary obligation. It may be used On top of that with common professional LCs. It is useful for both of those parties to mitigate the money hazards associated with huge trade orders. A economic address can assist both of those functions to barter improved trade conditions as well.

Also, little businesses can have problem competing in opposition to even larger and far better-recognized rivals. An SBLC can increase trustworthiness to its bid for any task and might generally occasions help stay away from an upfront payment to the vendor.

When you have to have an SBLC, it’s essential to have a system flow that’s clear and simple to follow. Our group understands this and operates intently with you to deliver the absolute best Answer that satisfies your necessities.

The consumers can make use of the Standby Letter of Credit to adjust in opposition to the down payments produced for the large contracts likewise. It decreases the risk for the client from the default or non-fulfillment of the seller. They can include Element of the total amount of the progress inside the SBLC.

Standby Letters of Credit (SLOC) are very important monetary instruments in international trade and domestic transactions, supplying a guarantee that obligations will probably be satisfied. They foster belief in between firms or entities engaged in substantial contracts.

Obtain loans by using your property holdings as protection, unlocking capital for various financial needs.

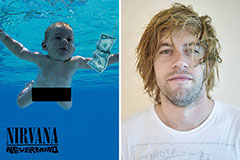

Spencer Elden Then & Now!

Spencer Elden Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!