Get hold of in depth qualifications checks executed by former FBI and CIA agents, giving thorough insights into folks or corporations.

Letters of credit are sophisticated, and Assembly all of the necessities is hard. Should you fail to fulfill a insignificant need, you could drop your proper to receive payment, which could prove disastrous.

To make sure a easy and prosperous method, you can find unique qualifications that consumers will have to meet up with. You need to have a minimum of $one.6 million USD to cover SWIFT and similar legal charges to the instrument you wish to invest in or lease.

When the letter has actually been delivered, a fee is then payable through the organization proprietor for each yeah which the Standby Letter of Credit stays superb.

We aid the issuance of standby letters of credit to empower significant transactions and enrich credit.

To monetize the SBLC, you’ll need to identify a reputable economic institution or investor keen to get or lend in opposition to the SBLC. Picking a husband or wife with expertise in SBLC monetization as well as a strong background is important.

We recognize that each shopper’s situation is exclusive, and we’re listed here to deliver methods to meet those requirements.

We occasionally see SBLCs in construction contracts as the Develop should fulfill several good quality and time specifications.

Considering the fact that a bank is getting a risk by giving a SBLC, you can find expenses to acquire one. Ordinarily, financial institutions will demand among one% and 10% of the whole guaranteed selling price for on a yearly basis which the SBLC is active.

As soon as this has actually been done, a notification is then sent for the lender in the bash who requested the Letter of Credit (usually the vendor).

There are numerous methods of SBLC monetization, which include discounting, assignment, and leasing. Discounting will involve the sale of the SBLC at a discount to its facial area worth. The beneficiary gets funds upfront, but at a reduced quantity when compared to the facial area worth of the SBLC.

Accessibility trade, receivables and supply chain finance We support firms to entry trade and receivables finance through our relationships with 270+ banking companies, funds and substitute finance properties.

When there is real worry which the financial institution won't pay out, then a verified letter of credit can be utilised. This may be where by a ‘stronger’ bank confirms the letter of credit.

Such as, suppose an exporter sends SBLC items into a purchaser in another country by using a guarantee to receives a commission in just sixty days. When the payment doesn’t arrive, the exporter can go to the purchaser’s financial institution to get paid alternatively.

Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Hailie Jade Scott Mathers Then & Now!

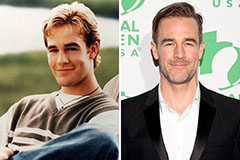

Hailie Jade Scott Mathers Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!